You keep seeing supplier price lists go up, blaming it on general inflation or shipping costs. But your old negotiation tactics aren't working, and the numbers just don't add up.

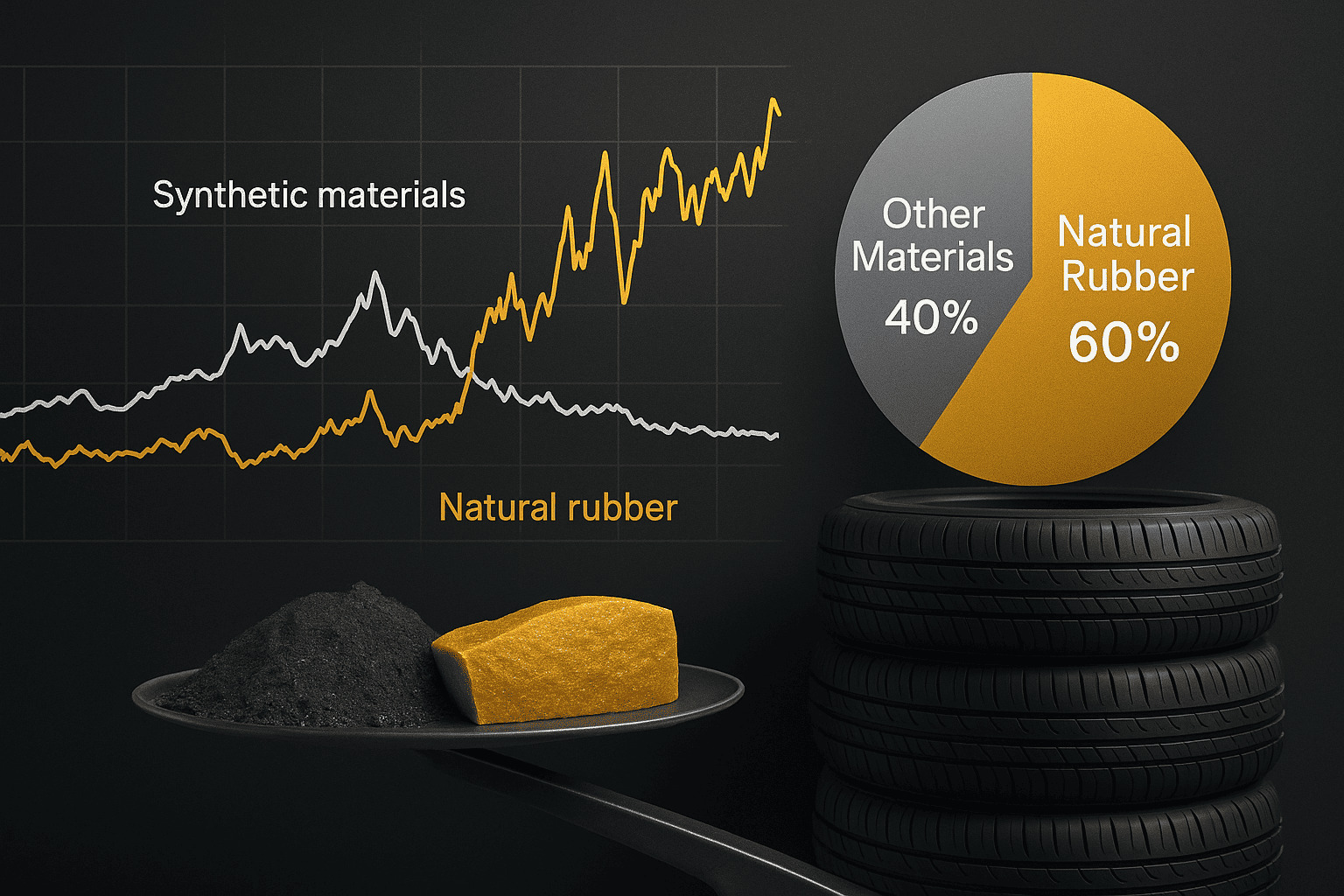

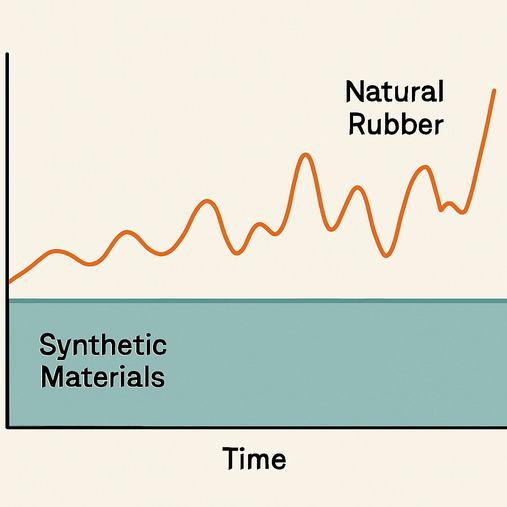

The industry is being reshaped by a fundamental imbalance in raw material costs, not just general price hikes. The disproportionate rise in natural rubber1's cost means a tire's material recipe, not its brand, now determines its price stability and your future profitability.

I remember sitting down with a large fleet manager about five years ago. He was proud of his procurement strategy. He'd negotiated a fixed price-per-kilogram for his tires, believing he had locked in his costs. Last year, his supplier hit him with a massive surcharge, breaking the agreement. Why? The contract didn't account for the radical shift in the cost of the ingredients. The price of the rubber inside the tire had skyrocketed, making his old price-per-kilogram model obsolete. He was focused on the total weight, but the real story was the changing value of what that weight was made of. This is the new reality we all face.

Why Doesn't Saving 1% of Material Save You 1% on Cost Anymore?

You've always pushed your suppliers for leaner designs, assuming that reducing material weight would directly cut costs. But now, you're seeing lighter tires that are somehow even more expensive, and it makes no sense.

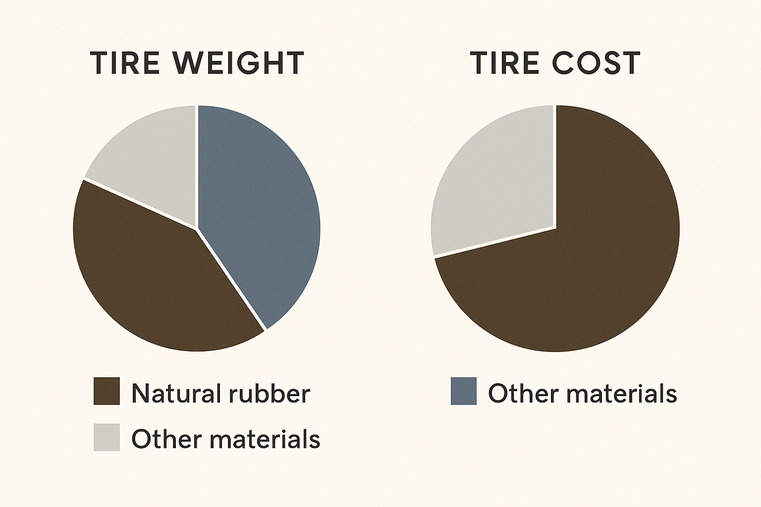

Because the cost is not evenly distributed across the materials. Saving 1% of a cheap filler is meaningless when the cost of natural rubber1, which can be 40% of a tire's weight, now dictates over 60% of its total material cost. The leverage has shifted.

In the past, the game was about scale. Factories that could produce more, could buy raw materials in bulk and drive down the cost of everything. A big, heavy tire was simply a sum of its parts, and more parts meant more cost. Today, that logic is broken. The market has created a massive imbalance where one ingredient—natural rubber1—is disproportionately expensive. A tire designed for heavy-duty applications might need a high percentage of natural rubber1 for its performance characteristics2. This tire is now financially penalized by the market. Saving a bit of steel in the bead or changing a synthetic filler has a tiny impact compared to the enormous cost locked into its rubber content. The focus has shifted from just building bigger to building smarter.

The New Cost Equation

| Tire Type | Material Composition (by Weight) | Old Cost Logic (Assumed) | New Cost Reality (Actual) |

|---|---|---|---|

| Standard Tire | 20% Natural Rubber, 80% Other | Cost is evenly spread | 40% of cost is from rubber |

| Performance Tire | 45% Natural Rubber, 55% Other | Cost is slightly higher | 70%+ of cost is from rubber |

Is Your Tire's Material Mix Locking In Future Price Hikes?

You are trying to forecast your budget, but sudden surcharges3 and "market adjustments" from suppliers make it impossible. You feel like you're reacting to price changes instead of planning for them.

Yes, because high-dependency on volatile materials like natural rubber1 essentially "locks in" future price instability. A tire's specific material composition4 is now the single biggest indicator of its vulnerability to market shocks5, making material engineering6 more important than ever.

Costs are no longer just "rising" in a predictable way. They are being structurally determined by a tire's DNA. If a tire relies heavily on natural rubber1, its cost is permanently tied to a volatile, unpredictable commodity. No amount of branding, marketing, or efficient production can shield it from that reality. This is why the new frontier of competition is in material engineering6. The smartest manufacturers are not just trying to find cheaper rubber; they are re-engineering tires from the ground up to minimize their dependency on it without sacrificing performance. They are optimizing the structure, blending advanced synthetic polymers7, and finding ways to deliver the required strength and heat resistance with a more stable and predictable cost base. As a buyer, you need to start asking your suppliers not just about their price, but about their material strategy.

Conclusion

The tire industry's economics have fundamentally changed. Profitability is no longer about brand or scale, but about mastering material science to escape the volatility of an imbalanced market.

Understanding natural rubber pricing trends can help you anticipate costs and adjust your procurement strategies. ↩

Understanding performance characteristics can guide you in selecting the right tires for your needs. ↩

Investigating the reasons behind surcharges can help you negotiate better terms with your suppliers. ↩

Exploring the impact of material composition on pricing can provide insights into cost-saving opportunities. ↩

Understanding market shocks can prepare you for sudden price changes and help you strategize effectively. ↩

Discovering the importance of material engineering can enhance your understanding of competitive advantages in the industry. ↩

Exploring the benefits of synthetic polymers can reveal innovative solutions for cost-effective tire production. ↩