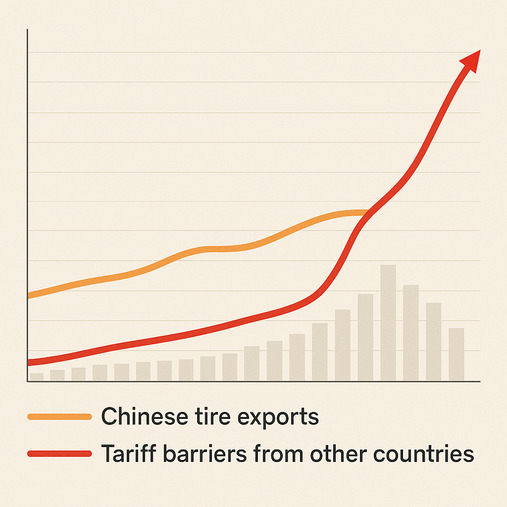

You've built your business on the affordability1 of Chinese tires2. But now, that same low price is attracting unwanted attention, creating tariffs3 and threatening the stability of your supply chain.

"Cheap" is a weapon because it grants massive market access. It's a wound because this "dumping" perception triggers global tariffs3 and anti-dumping actions4, while also preventing brands from building long-term value and customer loyalty beyond price.

For over a decade, I've watched the word "cheap" define my industry. In the early days, it was our key to the world. We could walk into any negotiation and win on price. It fueled an incredible expansion that turned China into the world's tire factory. But over time, I saw that weapon start to cut us, too. The same low prices that opened doors also painted a target on our backs. My conversations with clients shifted from celebrating low costs to strategizing around anti-dumping investigations. We won the battle for market share5 but found ourselves in a war against the perception that our products were only valuable because they were cheap.

Why Did Our Greatest Strength Become Our Biggest Headache?

You found a reliable, low-cost tire supplier in China, making your business more competitive. Now, that advantage is being eroded by international trade disputes focused solely on that low price point.

Because the low price that helped you penetrate markets became the very reason for global backlash. Countries initiated anti-dumping actions4 not due to poor quality, but because the tires were "too cheap," threatening their local industries.

I remember the early 2010s. It felt like we couldn't lose. Our prices were our superpower. But then the notices started coming in from the U.S., then Europe, then Brazil and India. They all said the same thing: "anti-dumping." It wasn't about our quality; our tires met and often exceeded international standards. It was purely about price. We were accused of selling below our domestic market cost or a "fair" value. This strategy, which felt like smart business to us, was seen as a hostile act by others. Relying on price alone creates no brand loyalty6. When a cheaper option appears, the customer leaves. It’s a race to the bottom that leaves you with thin margins and zero security. We gained entry, but we failed to build a foundation.

The Price Paradox in Action

| Price Strategy | The Intended Weapon (Advantage) | The Unintended Wound (Disadvantage) |

|---|---|---|

| Below-Market Pricing | Rapidly gain market share5 from established players. | Triggers anti-dumping investigations and high tariffs3. |

| Focus on Affordability | Appeal to budget-conscious buyers and large fleets. | Creates no brand loyalty6; customers switch for a lower price. |

| Volume over Margin | Dominate the market through sheer volume of sales. | Squeezes profit margins, making the business unsustainable long-term. |

Is ‘Made in Thailand’ the Answer to the ‘Cheap China’ Label?

You've heard that sourcing from Chinese-owned factories in Southeast Asia7 is the smart way to avoid tariffs3. But you're worried if this is a real long-term solution or just another temporary loophole.

Partially, yes. Moving production to countries like Thailand helps brands escape the immediate "Made in China" origin bias and tariffs3. This allows them to reset their pricing strategy8 and improve brand perception in Western markets.

This is one of the biggest strategic shifts I've seen in my career. For years, the smartest Chinese manufacturers saw the writing on the wall. They knew relying on mainland production was becoming a liability. So, they invested heavily in building state-of-the-art factories in Thailand, Vietnam, and Malaysia. This wasn't just about dodging tariffs3; it was a rebranding exercise9. Suddenly, a tire wasn't just a "cheap Chinese tire." It was a high-quality product from a modern Thai factory. This allowed my partners to approach European and American markets with a new story. They could command better prices because they were no longer automatically benchmarked against the lowest-cost domestic Chinese brands. It’s a way to break free from the price trap and start a new conversation centered on quality and performance, not just origin.

Are Chinese Tire Brands Finally Moving Beyond Just Price?

You see some Chinese brands on TV or sponsoring events and wonder if it's just marketing fluff. You want to know if there is a real shift from a "sell cheap" mentality to a "build value" strategy.

Yes, leading brands are actively moving from selling cheap to building value. They are investing heavily in branding, sponsoring major sports events, and adopting sophisticated pricing strategies to build long-term brand equity10 and pricing power.

The old guard of Chinese factory owners believed the product sold itself. The new generation knows that the brand sells the product. The real enemy was never the price itself, but the total reliance on it. There’s nothing wrong with being affordable, but it's a disaster if that's your only selling point. I now work with manufacturers who have dedicated marketing teams and multi-million dollar branding budgets. They are sponsoring football clubs in Europe and racing teams in the U.S. This isn't just for show. It's a calculated investment to change perception. When a customer sees a brand sponsoring their favorite team, the conversation is no longer about getting the cheapest option. It’s about trust, performance, and identity. This shift is crucial for sustainable growth11 and escaping the race to the bottom.

So, Does the World Still Need Affordable Tires?

With all this talk of branding and moving upmarket, you might think the era of the affordable tire is over. You need to know if you can still find value-driven options12 for your customers.

Absolutely. The global market is not uniform; it needs both high-performance premium tires and high-accessibility affordable tires. Strategic clarity, not just a high or low price, is what will define success for manufacturers and distributors.

Let's be realistic. Not every truck driver, farmer, or family needs the most expensive, high-performance tire on the market. There will always be a massive, essential demand for reliable, safe, and affordable tires. The mistake was thinking this was the only market China could serve. The future of our industry isn't about abandoning the value segment; it's about having strategic clarity. The winning companies will be those that choose their lane. Some will focus on building global premium brands13, competing with the likes of Michelin and Bridgestone on technology and branding. Others, like us at Gescomaxy, will continue to perfect the art of delivering high-quality, high-accessibility tires for the customers who value performance and cost-effectiveness14. The key is to make a choice, build your strategy around it, and deliver exceptional value within that chosen segment.

Conclusion

China’s tire industry is learning that price is a powerful tool, not a complete strategy. The future lies in balancing affordability1 with brand value to achieve sustainable global success.

Explore how affordability influences consumer choices and market dynamics. ↩

Explore insights on how Chinese tires can offer competitive advantages in pricing and quality. ↩

Learn about the implications of tariffs on international trade and supply chain management. ↩

Understanding anti-dumping actions can help businesses navigate trade disputes effectively. ↩

Discover effective strategies for increasing market share in competitive industries. ↩

Explore methods to foster brand loyalty that can lead to long-term customer retention. ↩

Find out how sourcing from Southeast Asia can help businesses avoid tariffs and improve brand perception. ↩

Gain insights into various pricing strategies that can enhance profitability and market presence. ↩

Learn about the significance of rebranding in changing market perceptions and enhancing value. ↩

Understand the importance of brand equity and strategies to develop it over time. ↩

Learn about strategies that can lead to sustainable growth in competitive industries. ↩

Explore the importance of offering value-driven options to meet diverse customer needs. ↩

Learn about the strategies premium brands use to differentiate themselves in the market. ↩

Discover ways to enhance cost-effectiveness while maintaining quality and performance. ↩