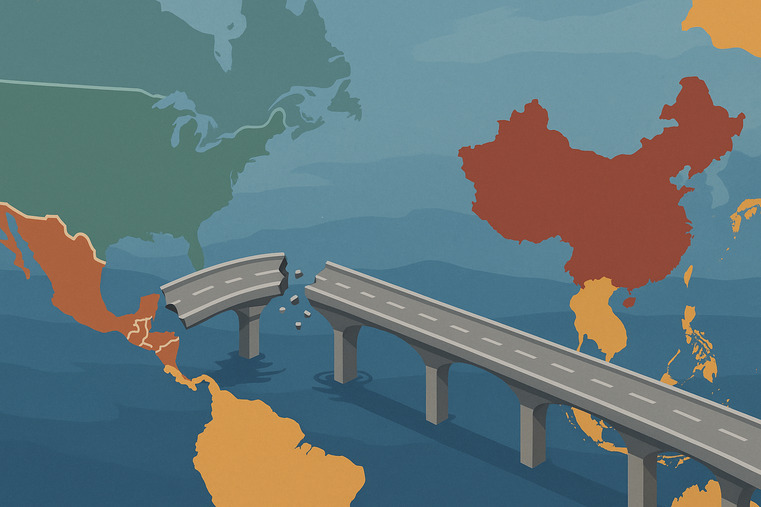

You heard Mexico was the clever workaround for U.S. tariffs on Chinese goods. So you planned your logistics around it, only to now face new tariffs and investigations from Mexico itself.

Mexico has become a difficult route because of its own broad tariff hikes1 and new anti-dumping actions against Chinese products. This has effectively closed the loophole for simply re-exporting tires to the U.S.

About six months ago, a client in Texas was excited. "We're setting up a warehouse in Tijuana," he told me. "We'll ship tires from you to Mexico, truck them across the border, and completely avoid the U.S. tariffs. It's the perfect plan!" At the time, I cautioned him that this strategy had a short shelf life. Sure enough, he called me last week, frustrated. A shipment was stuck, and he was facing unexpected duties from the Mexican side. His "perfect plan" had become a costly headache. This is a story I'm hearing more often. The game has changed, and simply using Mexico as a stopping point is no longer a viable strategy.

What Changed to Make Mexico a More Difficult Route?

You thought the USMCA trade deal2 made Mexico a safe zone. Now you're hearing about new duties and legal actions, making you wonder what exactly happened to this supposedly easy route.

Mexico launched its own tariff hikes1 (up to 35%) on hundreds of goods from countries without trade agreements, including China. It also initiated anti-dumping investigations3 specifically targeting Chinese truck and bus tires.

The situation in Mexico changed rapidly with a two-pronged attack on the old trans-shipment model. First, the Mexican government imposed sweeping temporary tariffs4 on over 500 products, which included steel, aluminum, and yes, rubber tires. This wasn't a targeted action but a broad measure that instantly added cost and complexity. Second, and more directly, Mexico began its own anti-dumping (AD) investigation into new pneumatic tires5 for trucks and buses originating from China. This is a game-changer. An AD investigation means that even if you manage to navigate the general tariffs, you could be hit with punitive, company-specific duties that could double your costs overnight. The simple act of moving a container from a Chinese port to a Mexican port and then to the U.S. is now under intense scrutiny from both sides of the border. The era of using Mexico as a simple "pass-through" is officially over. Shortcuts are being replaced by compliance checks.

The Old Way vs. The New Reality

| Aspect | The "Old Way" (Pre-2024 Thinking) | The "New Reality" (2025 and Beyond) |

|---|---|---|

| Strategy | Ship from China to Mexico, then truck to the U.S. to bypass U.S. tariffs. | Multi-origin sourcing; use ASEAN for U.S. market, consider Mexico for local production. |

| Mexican Tariffs | Assumed to be low or non-existent for Chinese goods. | Broad tariffs of up to 35% on many products, including tires. |

| Legal Risk | Low. The focus was only on U.S. customs. | High. Active anti-dumping investigations3 by Mexico against Chinese tires. |

| Outcome | Lower landed costs and easy access. | Higher costs, shipment delays, and significant legal and financial risk. |

How Can You Maintain Access to the North American Market Now?

Your Mexico strategy is broken, and you still need a reliable, cost-effective way to get tires into the U.S. You're worried about finding a new path that won't close down in another year.

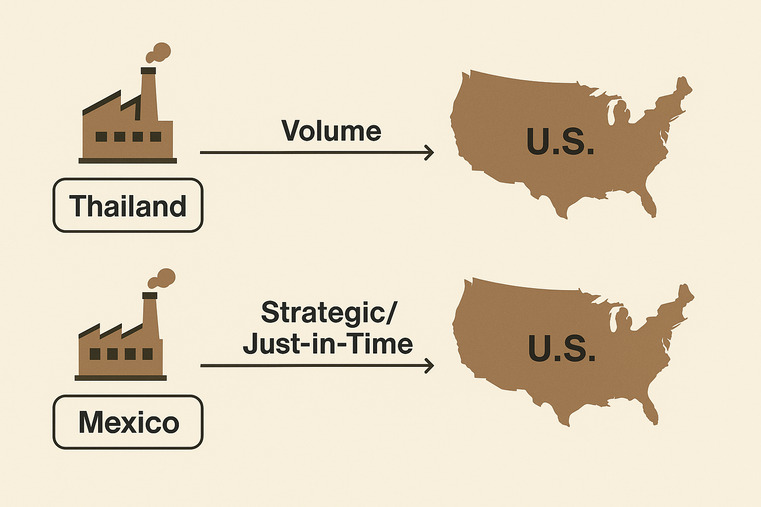

Adopt a dual-path strategy. Use established, tariff-free production hubs in ASEAN countries6 like Thailand for high-volume orders. Simultaneously, explore selective, true local manufacturing7 in Mexico for strategic, time-sensitive products.

The smartest approach now is not to find a single new loophole, but to build a resilient, multi-origin supply chain. For the bulk of your standard tire needs, the answer is Southeast Asia (ASEAN). For years, Chinese companies like us have been building massive, modern factories in Thailand and Vietnam. These plants are not subject to the same U.S. tariffs and are proven, high-quality production centers. This is your reliable engine for volume. At the same time, don't write off Mexico completely. Just change how you see it. Instead of a re-export hub, view it as a potential site for final assembly8 or manufacturing. For certain high-value products or specific customer needs where just-in-time delivery9 is critical, having a facility in Mexico that performs substantial transformation (not just relabeling) can make sense. This dual-path strategy gives you the best of both worlds: the cost-effective, tariff-free volume from ASEAN and the strategic speed and proximity of Mexico for specialized needs. It requires a partner who can manage sourcing from both regions.

Building Your Dual-Path Supply Chain

| Path | Primary Region | Best For... | Key Benefit |

|---|---|---|---|

| Path 1: The Volume Engine | ASEAN (Thailand, Vietnam) | Standard TBR, Agricultural, and Industrial Tires in large quantities. | Tariff-Free Access: Direct, compliant, and cost-effective shipments to the U.S. market. |

| Path 2: The Strategic Arrow | Mexico (Local Manufacturing) | Custom SKUs, products needing Just-in-Time delivery, high-value niche tires. | Speed & Proximity: Unbeatable lead times to U.S. customers, reduced logistics complexity10. |

Conclusion

The easy Mexico bridge has closed. Success now comes from a smarter, dual-path strategy, using ASEAN for volume and Mexico for strategic local production, not simple trans-shipment.

Understanding the latest tariff hikes can help you navigate costs and compliance effectively. ↩

Explore the USMCA trade deal to understand its implications for your business strategy. ↩

Learn about anti-dumping investigations to better prepare for potential legal challenges in trade. ↩

Discover how temporary tariffs can affect your supply chain and cost structure. ↩

Gain insights into pneumatic tires to understand their role in the current trade landscape. ↩

Explore the advantages of sourcing from ASEAN to optimize your production and logistics. ↩

Understanding local manufacturing can help you leverage speed and reduce logistics costs. ↩

Learn about final assembly to optimize your production strategy in Mexico. ↩

Discover how just-in-time delivery can enhance efficiency and customer satisfaction. ↩

Understanding logistics complexity can help you streamline operations and reduce costs. ↩