You see headlines about China’s manufacturing slowing down and wonder about your tire supply. But this isn't a decline; it’s a strategic evolution that could disrupt your business if misunderstood.

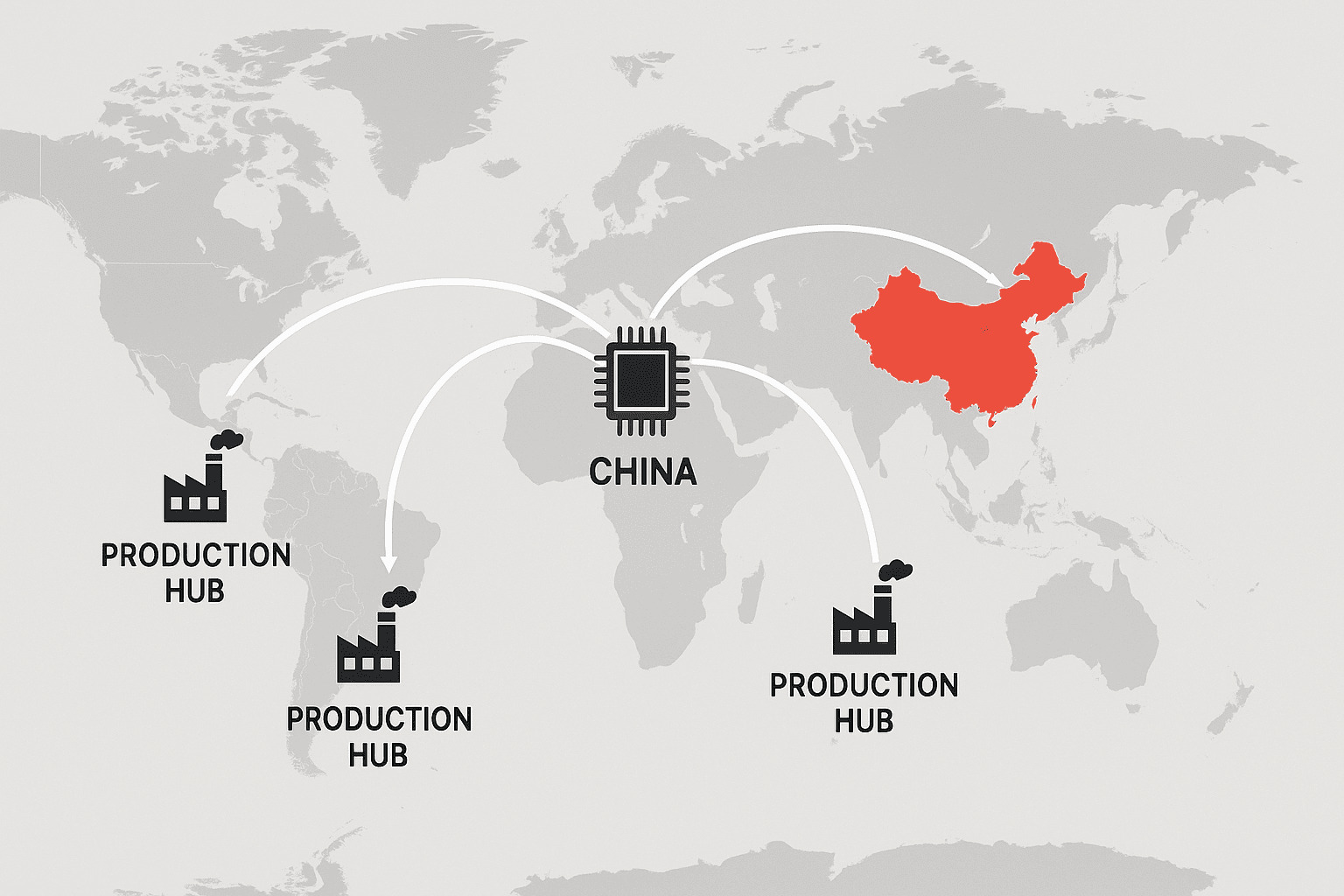

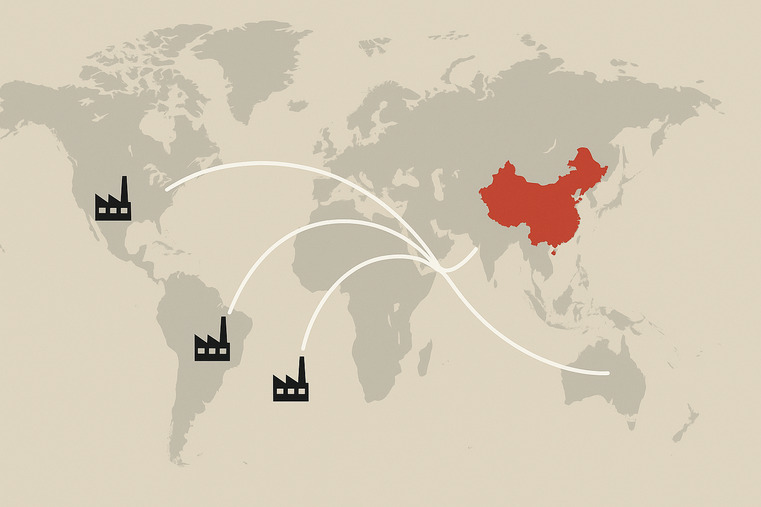

China is transforming from a single-country factory into a global network. It strategically moves production to different countries to bypass tariffs and access markets, while keeping high-tech research1 and smart manufacturing2 centralized at home.

For years, my job was simple: connect clients with the best factory in China. We had endless capacity. But recently, I’ve seen a change. Some old, massive factories are reducing lines, while shiny new R&D centers for EV tires are popping up elsewhere. At first, it seemed contradictory. I had clients asking me, "Is China getting out of the tire business?" The truth is far more interesting. China isn't getting out of the business; it's changing the rules of the game by creating a new kind of global supply chain3. This isn't an retreat; it's a redeployment.

Is This an Industrial Escape or a Strategic Upgrade?

You see Chinese production capacity moving overseas and worry it’s a sign of decline. You fear this shift might mean less reliability or a loss of the advantages you’ve counted on.

It's a strategic upgrade, not an escape. China is deliberately splitting its capabilities: high-volume production moves abroad to gain cost and tariff advantages, while high-value, tech-driven R&D and smart manufacturing2 remain in China.

I’ve had to explain this to many partners recently. They see a plant in Shandong province reduce its truck tire output and panic. But what they don't see is that the same company is building an AI-powered quality inspection4 lab in Shanghai and exporting its entire Industry 4.05 production system to a new factory in Vietnam. What’s going overseas is no longer just machinery and cheap labor. It's a full-stack capability: the compound formulas, the AI-driven inspection tech, the supply-chain finance models, and the operational expertise. China is keeping the "brain" and exporting the "muscle," turning its companies from simple contract manufacturers into global ecosystem nodes. It's a structural reallocation designed for a new era of global trade.

The New Dual-Hub Strategy

| Asset Location | Primary Function | Key Strengths & Outputs |

|---|---|---|

| Domestic (China) | Innovation & Control Hub | EV Tire R&D, Smart Manufacturing (Industry 4.05), AI Inspection, Compound Formulas, Centralized Management. |

| Overseas (e.g., SEA) | Production & Market Access Hub | High-Volume Production, Tariff Avoidance, Proximity to Raw Materials, Lower Logistics Costs for Regional Markets. |

Why Is "Where It's Made" More Important Than "How Much It Costs"?

For over a decade, you chose suppliers based on the lowest price from China. Now, constant trade wars and surprise tariffs make geography the most critical factor for a stable, profitable supply chain.

Because today’s competition is about profitable market access6, not just production cost. A factory in Mexico isn't just about labor; it's a legal, tariff-efficient bridge into the U.S. market. Making the tire is easy; entering the market profitably is not.

The era of simple, cost-driven offshoring is over. I remember when the only question was, "Which province in China is cheapest?" Now, the first question I ask my clients is, "Which market are you selling into?" The answer determines our sourcing strategy7. The new model is a sophisticated deployment based on tariffs, technology, and market segments. The smartest Chinese companies are no longer just "selling products"; they are "deploying production." They understand that future success won’t be decided by who makes the cheapest tire, but by who has the most resilient and efficient network to deliver that tire. Making a good tire is the baseline. Having legal, tariff-efficient, and geographically aligned production access is the real competitive advantage today.

The Global Deployment Playbook

| Country | Strategic Advantage | Target Market Served |

|---|---|---|

| Thailand | Raw Material Advantage (Natural Rubber) | Global, especially U.S. & Europe |

| Vietnam | Tax & Bonded-Zone Advantage | Global, strong U.S. access |

| Mexico | Legal & Tariff Bridge (USMCA) | North America (primarily U.S.) |

| Morocco | Tariff-Free Gateway | European Union & Africa |

If Southeast Asia Was the First Step, What's the Next Move in This Global Chess Game?

You've successfully navigated the shift by sourcing from Chinese-owned factories in Thailand or Vietnam. But now land costs are rising and capacity is getting tight. You need to know the next move.

The next move is towards new "low-friction" zones like Mexico, Morocco, and Egypt. Southeast Asia was the first dividend zone, but Chinese firms are now competing on compliance and rules8 to enter the next wave of markets.

Southeast Asia was the perfect answer to the first round of U.S.-China trade friction. But it was never the final destination. My partners who invested there early reaped huge rewards, but now they talk about rising land costs, labor shortages, and shrinking policy benefits. The field is getting crowded. The game is evolving again. The most forward-thinking companies I work with are already deep into their next move. They are preparing to compete on a whole new level: rules and compliance. Setting up a factory in Mexico isn't about finding cheap labor; it's about mastering the USMCA trade agreement9. Building in Morocco is about navigating EU regulations. The competition evolved from price (in China) to capacity (in Southeast Asia), and is now shifting to compliance (in North America and Europe). The winner will be the one who occupies an irreplaceable position by mastering these complex rules.

Conclusion

China's tire industry isn't shrinking; it's globalizing its footprint. Understanding this shift from a central factory to a strategic network is key to securing your future supply chain.

Discover cutting-edge advancements in high-tech research that are shaping the future of manufacturing. ↩

Learn how smart manufacturing is revolutionizing production processes and enhancing efficiency. ↩

Explore this link to understand the complexities and benefits of a global supply chain in today's economy. ↩

Find out how AI is enhancing quality control in manufacturing, ensuring better products. ↩

Delve into the principles of Industry 4.0 and how it's changing the landscape of manufacturing. ↩

Explore the importance of market access in global trade and how it affects business success. ↩

Learn about key considerations for creating an effective sourcing strategy in today's market. ↩

Gain insights into the role of compliance and regulations in shaping international trade. ↩

Understand the USMCA trade agreement and how it impacts trade between the U.S., Canada, and Mexico. ↩