You've budgeted carefully for your OTR tires. But when one unexpectedly blows out on a haul truck, the final bill is shockingly high, throwing your entire financial plan into chaos.

A single OTR tire blowout1 can easily cost a mine between $40,000 and $150,000 in a single day. This is due to massive losses from equipment downtime2, which far exceed the tire's purchase price of a few thousand dollars.

I once had a conversation with a mine manager who was fixated on getting the absolute lowest price per tire. He managed to save about $500 on each unit. He was proud of this until one of his haul trucks suffered a sidewall failure. The truck was down for nearly 10 hours. He later admitted to me that the lost production from that single incident cost his operation over $100,000. His $500 savings seemed like a joke in comparison. This is the brutal math of mining: the tire itself is a minor expense. The real cost is downtime. Understanding this changes how you should think about buying tires forever.

Why Is the Tire Price Just the Tip of the Iceberg?

You negotiate hard to lower your tire costs, believing this is where you save money. But a single, unexpected failure wipes out a year's worth of those "savings" in one afternoon.

The price of the tire is a controllable expense, often just 1-5% of the total cost of a failure. The real "destructive expense" is equipment downtime2, which can take a critical machine offline for 6-12 hours.

In mining, the most expensive piece of equipment is the one that isn't working. When a haul truck stops, the entire rhythm of the operation is broken. It's not a simple fix. The process is complex and slow: the area must be secured, the massive vehicle needs to be safely lifted, the damaged tire removed, a replacement found and fitted, and then everything re-inspected. This entire chain of events easily consumes 6 to 12 hours. While that's happening, the financial losses3 are piling up at an alarming rate. The focus on the tire's purchase price is a dangerous distraction. The real question isn't "how much does this tire cost?" but "how much will this tire protect me from downtime?"

The Real Cost: Tire vs. Downtime

| Item | Typical Cost (USD) | Type of Expense | Impact on Operation |

|---|---|---|---|

| 1 Premium OTR Tire | $3,000 - $12,000 | Controllable | A planned budget item. |

| 1 Hour of Downtime | $4,000 - $20,000 | Destructive | Unplanned loss of production. |

| 1 Day of Downtime | $40,000 - $150,000+ | Destructive | Catastrophic financial impact. |

What Are the Five Hidden Losses You're Overlooking?

A tire fails, and you budget for its replacement cost. But the final report shows a much larger financial hit, and you're struggling to explain where all the extra costs came from.

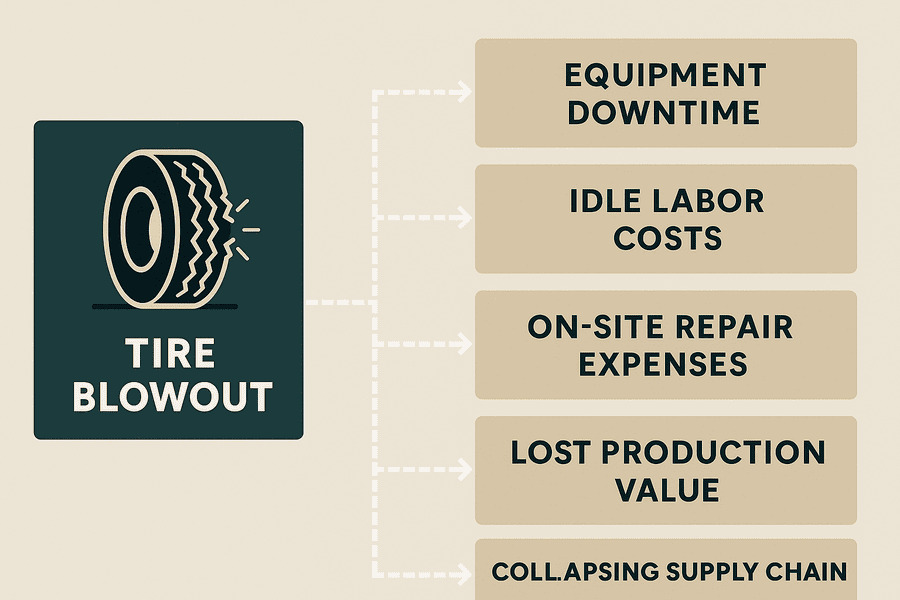

A tire blowout triggers five hidden losses: equipment downtime2, idle labor costs4, on-site repair expenses5, lost production value6, and a collapsing supply chain schedule. These secondary costs are what truly devastate a mining budget.

When a tire blows, the cost of the rubber is the least of your worries. The real damage comes from a cascade of other expenses that many buyers don't factor in. I call these the "five hidden losses." First, and largest, is the equipment downtime2. Your multi-million dollar haul truck is now a giant, useless rock. Second, you have idle labor. The operator, along with teams for loading and dispatch, are all being paid to wait. Third are the direct repair expenses5. Getting a service truck and specialized lifting equipment to a remote part of a mine is costly and complex. Fourth, and most critical, is the loss of production. Every hour the truck is down is tons of ore that isn't being moved, which is a direct loss of revenue. Finally, there are the supply chain ripple effects7, where schedules for other trucks and processing plants are thrown into disarray. This is why people in this industry say, "The tire isn't expensive. Downtime is."

Is It a 'Bad Tire' or Just the Wrong Tire for the Job?

Your tires keep failing from cuts and punctures, and you blame the manufacturer for poor quality. But your supplier keeps telling you the tires aren't defective, leaving you frustrated and confused.

Most mining tire failures are not due to manufacturing defects. They are caused by a structural mismatch, like using a tire with a weak casing in a rocky environment or one not designed to handle the site's heat and load.

This is one of the hardest lessons for purchasing managers to learn. It's easy to blame the tire's brand when it fails, but the reality is often more complex. The most common killers of mining tires are predictable and preventable. Sidewall cuts happen when you use a tire without enough reinforcement on sharp, rocky ground. Punctures occur when the steel belt package isn't strong enough to eject stones. Heat-related failures are a direct result of overloading, underinflation, or using a tire compound not built for your site's conditions. I have seen clients try to use a tire designed for a port—with its flat surfaces and long runs—in a quarry. The results are always catastrophic. The tire wasn't "bad"; it was simply the wrong tool. Choosing the wrong tire structure is a far more expensive mistake than choosing the wrong brand or price.

How Can You Prevent These Massive Downtime Losses?

You feel helpless against sudden tire failures and their huge costs. You accept downtime as an unavoidable part of mining, but you wish there was a more proactive way to control it.

You can dramatically reduce downtime by focusing on prevention. This involves three key actions: selecting the correct heavy-duty casing structure8 for mining, enforcing strict inflation management9, and performing regular tire inspections10 to remove embedded rocks.

The most effective way to save hundreds of thousands of dollars is not by negotiating tire prices, but by preventing failures in the first place. It comes down to three non-negotiable actions. First, use the correct casing construction. Mining is not the place for standard tires. You need a structure specifically designed for the abuse: Cut-Resistant compounds, Heavy-Duty casings, and Rock-Pattern designs11 like L5 or L5S. Second, you must have strict inflation management9. Being just 10% underinflated can increase heat by 20% and cut the tire's lifespan by up to 40%. It's the silent killer of OTR tires. Third, implement regular inspections and stone removal. A simple daily check to remove rocks stuck in the tread can reduce puncture incidents by over 50%. These are the data points that savvy managers use to justify investing in premium, correctly specified tires. They aren't buying a product; they are buying uptime.

Conclusion

A tire blowout's real cost is in lost production, not rubber. Proactive prevention through correct tire selection12 and maintenance is the most effective way to protect your mine's bottom line.

Understanding the financial impact of an OTR tire blowout can help you budget more effectively and prevent future losses. ↩

Explore how equipment downtime can lead to significant financial losses and disrupt mining operations. ↩

Understanding the financial implications of equipment failures can help you make informed decisions. ↩

Discover how idle labor costs can accumulate during equipment failures and affect your bottom line. ↩

Understanding repair expenses can help you plan better for unexpected equipment failures. ↩

Learn about the critical importance of maintaining production value to ensure profitability in mining. ↩

Explore how disruptions in the supply chain can lead to broader operational challenges. ↩

Learn about the importance of heavy-duty casing structures in preventing tire failures in harsh mining environments. ↩

Discover how proper tire inflation can significantly extend tire life and reduce downtime. ↩

Regular inspections can prevent costly tire failures and ensure operational efficiency. ↩

Learn how specialized tire designs can improve performance and reduce failures in rocky environments. ↩

Choosing the right tire is crucial for minimizing downtime and maximizing productivity in mining. ↩