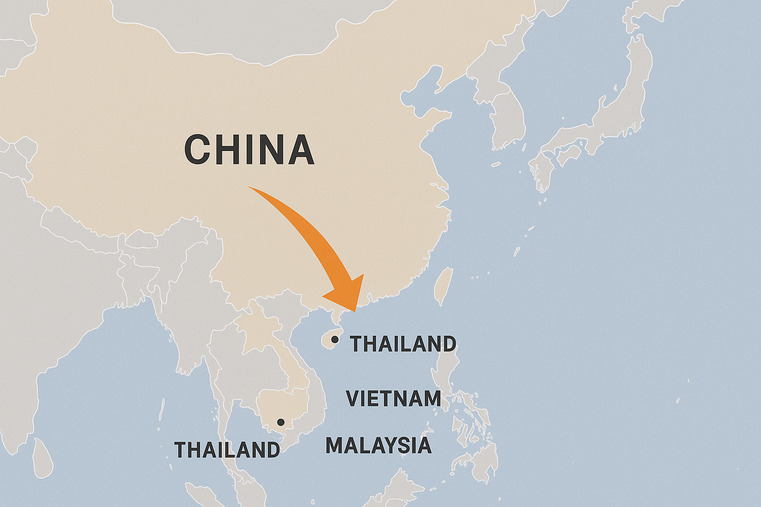

You see major Chinese tire brands setting up factories in Thailand and Vietnam. You might worry this signals instability. But it's a calculated move to build a stronger, more resilient global supply chain1.

Chinese tire manufacturers2 are moving to Southeast Asia primarily to bypass steep anti-dumping tariffs3 from the US and EU. They also gain access to cheaper labor, abundant natural rubber4, and are strategically upgrading their global supply chain1s for long-term growth.

I've been in this business for over 12 years. At first, everyone in the industry thought this was just about running from tariffs. It seemed like a simple reaction. But when I talked to factory owners I've known for a decade, the people actually investing hundreds of millions of dollars into these new plants, I realized the plan was much, much bigger. This isn't just an escape; it's an evolution. Let's break down what's really happening.

Is this just an escape from trade tariffs?

Your business relies on a stable supply of tires. Suddenly, you hear about anti-dumping duties on Chinese products. You're worried about price hikes and disruptions that could destroy your margins and planning.

Yes, escaping punitive tariffs, often called "double anti" duties (anti-dumping and countervailing), was the initial and most urgent reason. For manufacturers, these tariffs aren't just a tax; they are a wall that can completely lock them out of major markets like the US and Europe.

This move overseas was not a voluntary "globalization strategy" in the beginning. It was a forced march. I remember when the first major tariffs hit. Overnight, quotes for certain tire categories became completely non-competitive for the US market. It wasn't a matter of negotiating a few percentage points; the price was instantly 30-50% higher. You can't absorb that. So, the choice was simple: either lose your biggest export markets5 or find a new manufacturing base that wasn't on the tariff list. Southeast Asian countries like Thailand and Vietnam became the perfect escape route. Establishing a factory there meant your tires were now "Product of Vietnam," not "Product of China," effectively bypassing these trade walls.

Tariff Impact Breakdown

| Factor | Sourcing from China | Sourcing from Southeast Asia |

|---|---|---|

| US/EU Tariffs | Subject to high "Double Anti" duties | Not subject to the same duties |

| Market Access | Severely restricted or blocked | Open and competitive |

| Price Stability | Volatile and subject to political changes | More predictable and stable |

| Business Risk | Extremely High | Significantly Lowered |

This wasn't about being unpatriotic; it was about pure survival. The tariffs forced the industry's hand, pushing it to find a new way to compete on the global stage.

Is Southeast Asia just the "new China"?

You hear about lower wages and a young workforce in Vietnam. It sounds familiar, like the story of China's economic boom 20 years ago. You might think it's just a simple copy-and-paste of the old model.

In many ways, yes. Southeast Asia is replaying China's early-stage playbook. It offers a large, young labor force, lower operational costs, and a government eager for industrial investment6. For tire manufacturers, it's like stepping back in time to the golden era of Chinese manufacturing.

When I visit these new plants in Thailand, the energy feels exactly like it did in Qingdao or Weifang back in the early 2000s. You have millions of young, motivated people entering the workforce. Labor costs are significantly lower than in China today, which is a major factor in a labor-intensive industry like tire manufacturing7. But it's more than just wages. These countries are building the infrastructure—ports, highways, and industrial parks—needed to support massive industrial capacity. They are hungry for the kind of investment Chinese companies can bring. It's a perfect match. China has the capital, the technology, and the manufacturing know-how. Southeast Asia has the demographic and cost advantages8 that China used to have. It's a symbiotic relationship that allows the tire industry to continue its high-growth trajectory.

Why does being close to natural rubber4 matter so much?

You are focused on production costs like labor and energy. You might overlook the single biggest raw material expense in tire manufacturing7. A small saving on materials can have a bigger impact than cutting wages.

Proximity to raw materials is the ultimate cost advantage. China imports over 80% of its natural rubber4, mainly from Southeast Asia. By building factories in Thailand and Vietnam—the world's top rubber producers—manufacturers eliminate massive logistics costs and secure a more stable supply.

This is the point that many people miss, but for us in the industry, it's the most logical part of the whole strategy. Think about it. For years, Chinese factories would buy rubber from Thailand, ship it thousands of kilometers to China, turn it into a tire, and then ship that tire all the way back across the ocean to sell in Europe or America. It's incredibly inefficient. Every step adds cost and risk. By setting up shop right next to the rubber plantations, you cut out the middle leg of that journey entirely. You're not just saving on shipping; you get better prices, more stable supply, and less vulnerability to global shipping crises. This is the single biggest long-term, structural advantage of the move. While tariffs can change, the location of rubber trees cannot.

Is this more than just moving factories?

You see a company moving production and assume it's just a cost-cutting measure. It's easy to think they are simply lifting and shifting old equipment and old strategies to a new, cheaper location.

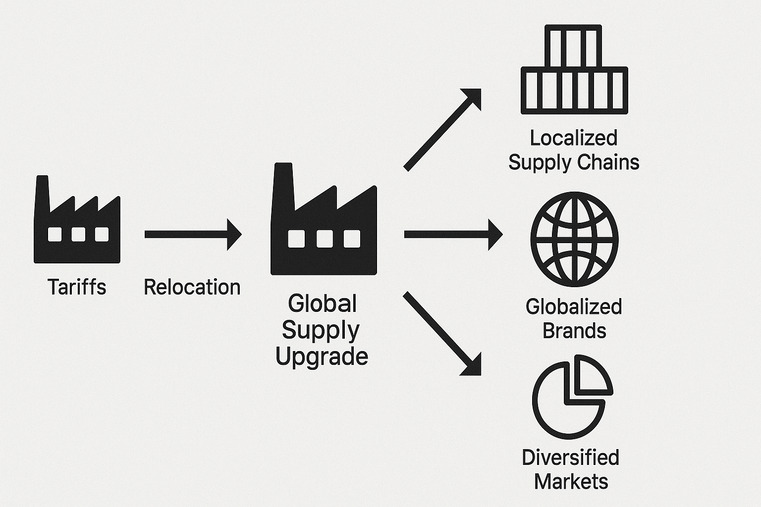

Absolutely. This is not just a relocation; it is a fundamental upgrade of the entire supply chain. Avoiding tariffs is phase one. Phase two involves building localized supply chains, creating globalized brands, and serving a more diversified portfolio of international markets directly from these new hubs.

The first factories that moved were simple "tariff-free assembly lines." But what's happening now is much more sophisticated. These companies are building entire ecosystems. They are developing local suppliers for other raw materials like carbon black and steel cords. They are setting up local R&D centers9 to tailor products for regional markets. They are no longer just "Chinese companies operating in Vietnam." They are becoming truly global companies with a Southeast Asian manufacturing base. This allows them to serve not only the US and Europe more effectively but also emerging markets in Asia, Africa, and South America. They are building a more resilient, decentralized, and ultimately more competitive global footprint. It's a strategic transformation from being a Chinese exporter to becoming a global manufacturer.

Are Chinese companies abandoning their home base?

You see this massive investment overseas and wonder if it means the end of tire manufacturing7 in China. Is the industry giving up on its home country and moving everything abroad for good?

No, this is not about abandoning China. It's about extending China's competitive edge. The strategy combines China's advanced production capacity and technology with Southeast Asia's cost advantages8 and market access10. It creates a powerful new formula for global competitiveness11.

The most advanced, high-tech, and automated tire production will likely remain in China. The Chinese domestic market is still the largest in the world, and it demands constant innovation. The overseas plants in Southeast Asia are a strategic complement, not a replacement. Think of it this way: China provides the "brain" (R&D, capital, advanced technology) and the high-end production. Southeast Asia provides the "muscle" (cost-effective, high-volume production12 for export). This "China + 1" strategy allows the entire industry to become more powerful. It can fight on two fronts: leveraging Southeast Asia to win in cost-sensitive international markets while using its Chinese base to lead in technology and serve its massive home market. It's the best of both worlds.

Conclusion

The move to Southeast Asia is a smart, multi-layered strategy. It solves the immediate problem of tariffs while building a more cost-effective, resilient, and truly global supply chain1 for the future.

Learn about the elements that make up an effective global supply chain. ↩

Explore how this shift impacts global supply chains and market dynamics. ↩

Understanding these tariffs can clarify their impact on global manufacturing strategies. ↩

Learn about the significance of natural rubber in production costs and supply chain efficiency. ↩

Explore strategies for manufacturers to penetrate and succeed in export markets. ↩

Explore the factors attracting investment in Southeast Asia's manufacturing sector. ↩

Stay updated on innovations and trends shaping the tire manufacturing industry. ↩

Explore how cost advantages can influence manufacturing location decisions. ↩

Learn how R&D centers contribute to innovation and product development in manufacturing. ↩

Discover the importance of market access in driving business growth and expansion. ↩

Learn strategies that companies use to remain competitive in the global market. ↩

Explore the role of high-volume production in meeting global demand and efficiency. ↩